Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Rebecca Burgin

Office Hours

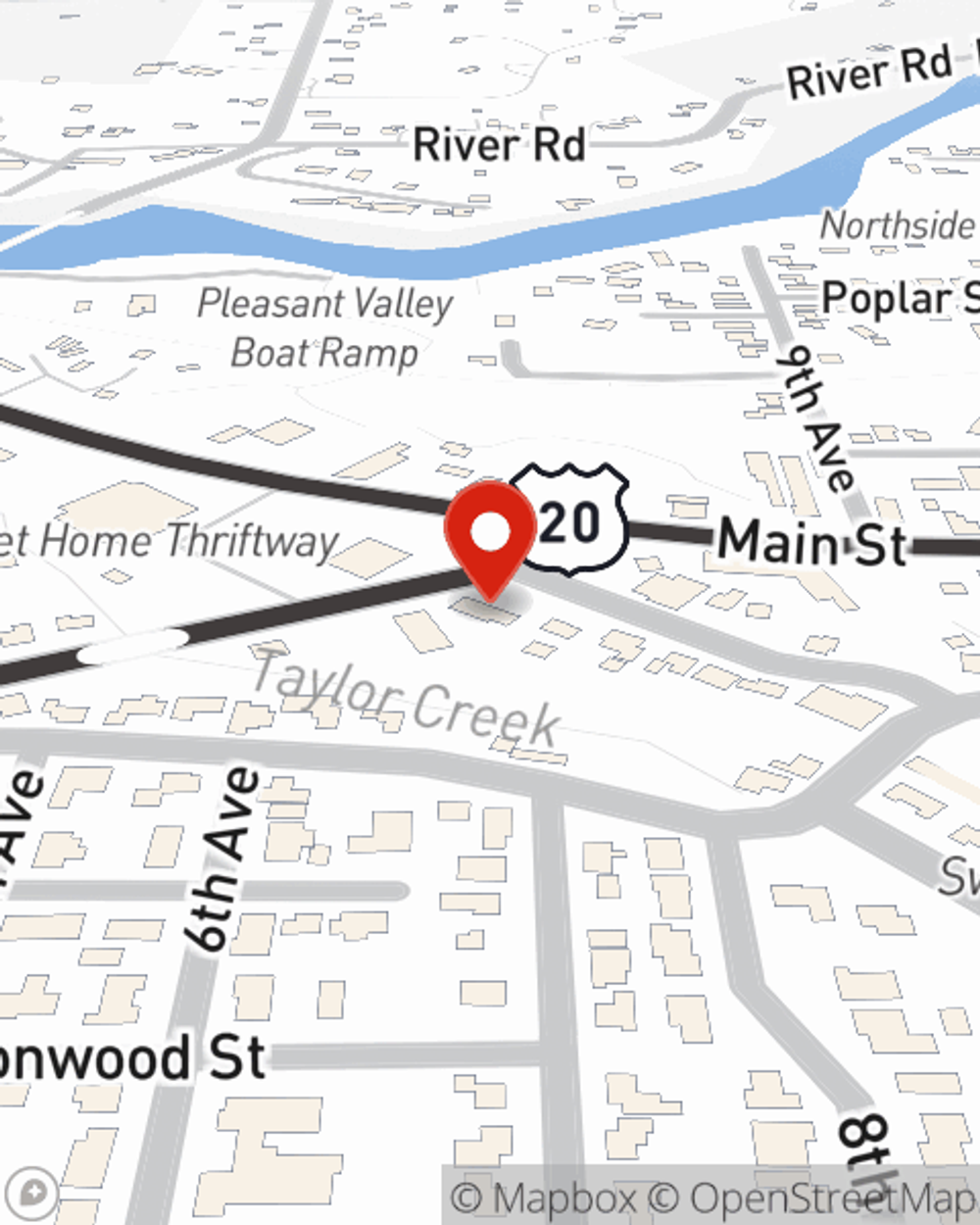

Address

Sweet Home, OR 97386-3304

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Office Info

Simple Insights®

How to recognize drowning signs

How to recognize drowning signs

The signs of drowning may surprise you. Here's how to recognize the common signs and tips for drowning prevention.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Viewing team member 1 of 3

Jenna Anderson

Office Manager

License #19080487

Jenna has over 7 years of experience in home, auto, renters and life insurance. Jenna is our office manager and is my right hand. She was born and raised right here in Sweet Home and has a passion for helping others. Jenna is mom to a son and 2 doggies.

Viewing team member 2 of 3

Katie Ventura

Account Manager

License #18480152

Katie has been with State Farm for 8 years and is extremely knowledgeable in home, renters, life and auto insurance. Katie grew up in Sweet Home and Lebanon and is mom to two lucky kiddos. Reach out to her with any insurance questions or for a quote.

Viewing team member 3 of 3

Felecia Richards

Account Manager

License #20092506

Felecia joined State Farm in 2021 and is passionate about life insurance and all of your other insurance needs. She has 3 grown sons and 2 grandchildren.